Trawling through Reddit forums for travel advice is a rite of passage for the modern explorer. One question appears more than any other: ‘What’s the best way to handle money abroad?’ The debate rages on—credit cards, debit cards, or a wad of local cash? The truth is, relying on a single method in 2026 is a recipe for disaster, or at the very least, a wallet full of unnecessary fees.

Getting your travel money strategy right is just as important as booking your flights. A smart approach not only saves you money but also gives you peace of mind. Just like how a reliable data plan keeps you connected, a flexible payment strategy keeps you financially secure. Before you even pack your bags, why not secure your connection? Try a free eSIM from Yoho Mobile to see how seamless staying online can be.

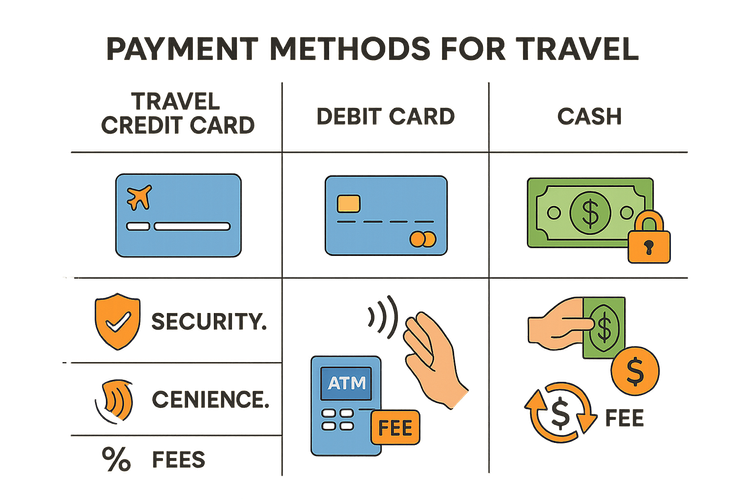

The Case for Credit Cards: Convenience Meets Security

For many travelers, the credit card is king. It offers unparalleled convenience, robust fraud protection, and often, valuable travel rewards. When debating credit card vs debit card for international travel on Reddit, users frequently praise the zero-liability policies of major credit card companies. If your card is stolen, you’re typically not on the hook for fraudulent charges.

However, this convenience can come at a cost. Many cards tack on a foreign transaction fee, usually around 3% of every purchase. Another sneaky charge is Dynamic Currency Conversion (DCC), where a merchant offers to charge you in your home currency. While it seems helpful, it almost always comes with a terrible exchange rate. The golden rule: always choose to pay in the local currency. To make credit cards work for you, find one that explicitly offers no foreign transaction fees.

The Debit Card Dilemma: Your Gateway to Local Cash

Debit cards are your direct line to cash from local ATMs, which is essential for markets, taxis, and smaller shops that don’t accept cards. This direct access is a huge plus. The main drawback, however, is the gauntlet of fees. You can be hit with a fee from your own bank for using an out-of-network ATM, plus a fee from the local ATM operator. These can add up quickly, making each cash withdrawal expensive.

Figuring out how to avoid foreign transaction fees with debit cards requires some homework. Look for banks or credit unions that are part of a global ATM alliance or offer to reimburse international ATM fees. Also, be aware that debit cards generally offer less robust fraud protection than credit cards. If your card is compromised, the money is taken directly from your account, and getting it back can be a lengthy process.

The Enduring Power of Cash: Why It Still Matters

In our increasingly digital world, it’s easy to dismiss physical cash. But in many parts of the world, cash is still the primary mode of transaction. When considering using cash vs card in Japan, for example, you’ll find that many smaller ramen shops, local markets, and traditional inns are cash-only. Carrying local currency is non-negotiable in these scenarios.

Cash is also a powerful budgeting tool; you can only spend what you have, which helps prevent overspending. The major downside is security. If you lose your cash or it’s stolen, it’s gone forever. This is where a travel money belt can be a wise investment. Furthermore, exchanging currency at airport kiosks often gives you the worst rates. It’s better to withdraw from a local ATM upon arrival or exchange a small amount at your home bank before you leave.

The Smart Traveler’s Hybrid Strategy for 2026

A truly savvy traveler doesn’t choose between card and cash; they use a hybrid approach to get the best of all worlds.

- Primary Spending: Use a no-foreign-transaction-fee credit card for major purchases like hotels, flights, and restaurant meals to maximize rewards and security.

- Cash Access: Carry a debit card from a travel-friendly bank to withdraw local currency from ATMs for smaller expenses.

- Emergency Buffer: Have a small amount of local currency on hand upon arrival for immediate needs like a taxi or a bottle of water.

This financial strategy perfectly complements a smart connectivity strategy. Just as you avoid paying extra on currency conversion, you should avoid exorbitant international roaming charges. With a Yoho Mobile eSIM, you can get affordable, high-speed data in over 200 countries. Our flexible plans allow you to choose the exact amount of data and days you need, so you only pay for what you use. Plus, with Yoho Care, you’re protected from ever losing connection, even if your data runs out.

Ready to travel smarter? Explore flexible eSIM plans for your next destination and stop worrying about data fees.

Frequently Asked Questions (FAQ)

What is the best way to carry money when traveling to Europe?

The best approach for Europe is a combination. Use a credit card with no foreign transaction fees for most purchases, as card acceptance is widespread. Carry a travel-friendly debit card to withdraw Euros from ATMs for smaller purchases or at establishments that prefer cash. Always have about €50-€100 in cash on you for convenience.

Should I exchange money before I travel?

It’s a good idea to exchange a small amount of money before you leave (e.g., $100 worth) to cover immediate expenses like transportation from the airport. You’ll generally get better exchange rates by withdrawing from a local ATM at your destination rather than using currency exchange services at the airport or in your home country.

What is dynamic currency conversion and how do I avoid it?

Dynamic Currency Conversion (DCC) is when an overseas merchant or ATM offers to convert the transaction to your home currency. While it seems convenient, the exchange rate used is typically poor, costing you more. To avoid it, always choose to be charged in the local currency (e.g., Euros, Yen, Pesos) when given the option on a card machine or ATM.

How can I protect my money while traveling?

Never carry all your cash and cards in one place. Use a money belt or a secure pouch for your main stash. Leave a backup card in your hotel safe. Inform your bank of your travel dates to prevent them from flagging your transactions as fraudulent. And for digital security, using a reliable data connection like an eSIM from Yoho Mobile is safer than relying on unsecured public Wi-Fi. Also, before you go, check if your device is compatible with eSIM technology.

The Savvy Conclusion: Stay Connected and Financially Secure

Navigating the world of travel money in 2026 doesn’t have to be complicated. The winning formula is a hybrid strategy: a fee-free credit card for secure spending, a low-fee debit card for cash, and a small reserve of local currency for everything in between. By planning ahead, you can dodge those pesky international fees and make your travel budget stretch further.

Pairing this financial savvy with smart connectivity is the final piece of the puzzle. A Yoho Mobile eSIM ensures you have the data you need to access online banking, use maps, and stay in touch without the fear of a massive phone bill.

Get started on your worry-free journey today. Claim your free trial eSIM and experience the freedom of seamless global connectivity.