As you start dreaming up your 2026 travel plans—whether it’s exploring the ancient streets of Rome or the bustling markets of Bangkok—your budget is likely top of mind. While you’re busy booking flights and accommodations, one of the biggest budget-killers can sneak up on you: hidden bank fees. Fortunately, the right financial tool can turn these pesky charges into valuable rewards. A top-tier travel credit card is essential for any international traveler, but it’s only half of the equation for a truly seamless journey. The other half? Smart, affordable connectivity.

At Yoho Mobile, we believe in savvy travel. That’s why we’re breaking down the best travel credit cards for 2026 and showing you how to pair them with an affordable eSIM for the ultimate travel experience. Ready to make your money and your data go further? Let’s start with a risk-free way to test your connectivity: get a free eSIM trial from Yoho Mobile before your trip!

Why a Travel Credit Card is Your Best Companion for 2026 Adventures

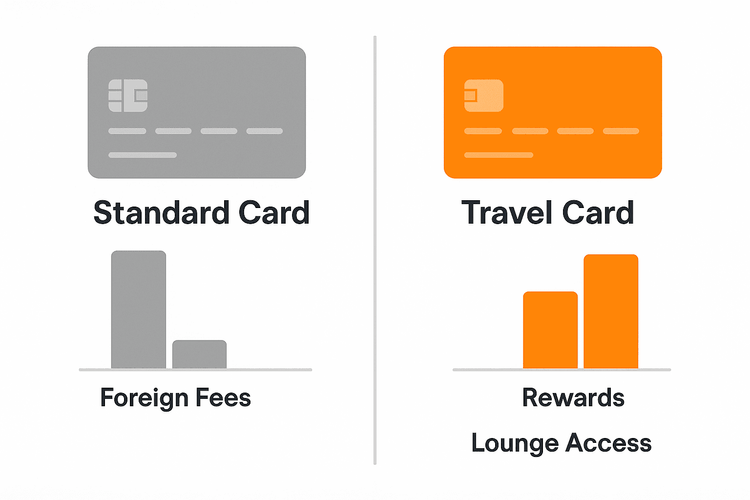

Using your everyday debit or credit card abroad can feel like a financial minefield. Many banks charge a foreign transaction fee, typically around 3% of every purchase you make. It might not sound like much, but on a two-week trip to Europe, that could easily add up to over $100 in unnecessary fees.

This is where a dedicated travel credit card shines. These cards are specifically designed for globetrotters, offering a suite of benefits that save you money and enhance your travel experience. Beyond just eliminating pesky fees, they open up a world of travel rewards, from complimentary flights and hotel stays to exclusive access and peace of mind with built-in travel insurance. Think of it as your financial passport to smarter, more rewarding travel.

Key Features to Look for in a Top-Tier Travel Credit Card

When comparing the best travel credit cards for international travel, it’s crucial to look past the welcome bonus. The real value lies in the card’s long-term features that align with your travel style.

Zero Foreign Transaction Fees: The Non-Negotiable

This is the most fundamental feature. A card with no foreign transaction fees ensures that the price you see is the price you pay, whether you’re buying a croissant in Paris or a souvenir in Tokyo. This single perk can save you a significant amount of money over the course of your travels, making it a must-have for any international journey.

Lucrative Rewards Programs: Points, Miles, and Cashback

Great travel cards reward you for your spending. These travel rewards typically come in three flavors:

- Miles: Ideal for frequent flyers, these can be redeemed for flights, often with specific airline partners.

- Points: More flexible, points can usually be used for flights, hotels, car rentals, or even statement credits.

- Cashback: The simplest option, offering a percentage of your spending back in cash.

Look for cards that offer bonus rewards on travel-related purchases like airfare, dining, and hotels.

Airport Lounge Access: Travel in Comfort

Long layovers become a lot more pleasant with airport lounge access. Many premium travel cards include a complimentary membership to lounge networks like Priority Pass, giving you a quiet space to relax, enjoy free food and drinks, and access Wi-Fi before your flight. This perk alone can be worth hundreds of dollars a year for frequent travelers.

Valuable Travel Perks & Insurance

Top-tier cards often come with a safety net of travel insurance benefits, including trip cancellation/interruption coverage, lost luggage reimbursement, and primary rental car insurance. These protections can save you from major headaches and unexpected expenses if things don’t go as planned.

Our Top Picks for the Best Travel Credit Cards in 2026

Disclaimer: Card names are for illustrative purposes. Always check the latest terms and conditions from financial institutions like NerdWallet or The Points Guy before applying.

The Globetrotter’s Choice

This type of card is perfect for the frequent international traveler. It typically comes with a higher annual fee but pays for itself with a large sign-up bonus, generous airline mile multipliers, comprehensive travel insurance, and premium benefits like annual travel credits and unlimited airport lounge access.

The Savvy Saver’s Pick

Ideal for the budget-conscious traveler or those new to travel hacking, this category often includes cards with no annual fee. While the perks might be fewer, it will always include no foreign transaction fees and offer solid, straightforward cashback or points on all purchases, making it a simple and effective tool for saving money abroad.

The Luxury Traveler’s Companion

For those who prioritize comfort and premium experiences, these elite cards offer the pinnacle of travel perks. Expect high annual fees but exceptional benefits like hotel elite status, airline fee credits, dedicated concierge services, and access to the most exclusive airport lounges worldwide.

Travel Hacking 101: The Other Half of Smart Travel is Your Connectivity

Travel hacking 2026 is about more than just credit card points; it’s about a holistic approach to saving money and traveling smarter. Once you’ve eliminated foreign transaction fees with the right card, the next major money pit to address is international data roaming. Relying on your home carrier’s roaming plan can result in astronomical bills, easily erasing the savings you made on transaction fees.

This is where a modern solution like an eSIM (embedded SIM) becomes indispensable. Instead of fumbling with tiny plastic SIM cards or hunting for Wi-Fi, you can download a data plan directly to your phone. With Yoho Mobile, you can choose from flexible plans tailored to your destination and needs. You create your own package—combining countries, data amounts, and duration—so you only pay for what you actually use. It’s the ultimate way to control your connectivity costs.

Pair Your Travel Card with a Yoho Mobile eSIM for Maximum Savings

Imagine this scenario: you’re on a multi-country trip through Southeast Asia, starting in Thailand and heading to Vietnam. You use your travel rewards card to pay for a street food tour in Bangkok, earning points without any foreign transaction fees. While navigating the city, you’re using an affordable Yoho Mobile eSIM data plan for Asia to use Google Maps, upload photos, and video call family back home.

You avoid exorbitant roaming charges and stay connected effortlessly. This powerful combination—the best travel credit card and a flexible eSIM—is the key to a stress-free and budget-friendly adventure in 2026. Best of all, you can set up your eSIM in minutes before you even leave home. Just make sure your device is compatible by checking our eSIM compatible devices list.

For iOS users, the process is even simpler: after purchase, just tap the ‘Install’ button in the app to activate your plan in under a minute—no QR codes needed!

Frequently Asked Questions (FAQ)

How do I avoid foreign transaction fees when traveling abroad?

The most effective way is to use a credit card that specifically advertises no foreign transaction fees. These are widely available and are a core feature of any good travel credit card. Using one for all your international purchases will ensure you’re not paying an extra 1-3% on everything you buy.

Are travel credit cards with annual fees worth it?

It depends on your travel frequency and style. For frequent travelers, the benefits of a card with an annual fee—such as airport lounge access, annual travel credits, and higher reward rates—often outweigh the cost. For occasional travelers, a no-annual-fee travel card might be the more cost-effective choice.

What’s a simple way to stay connected internationally without high roaming costs?

An eSIM from a provider like Yoho Mobile is the easiest and most affordable solution. You can purchase and install a data plan for your specific destination directly on your phone before you travel. This gives you access to local data rates and prevents the shock of a high roaming bill when you return home.

Can I use an eSIM and my physical SIM at the same time?

Yes, most modern dual-SIM phones allow you to use both an eSIM and a physical SIM simultaneously. This is a great feature for travelers, as you can keep your primary phone number active for calls and texts on your physical SIM while using your Yoho Mobile eSIM for affordable data. You can learn more about how it works in our guide on using eSIMs for travel.

Conclusion: Your Ultimate Duo for Smarter Travel in 2026

As you plan your next great adventure, think of your financial and digital tools as part of your essential gear. A powerful travel credit card eliminates unnecessary fees and rewards you for your spending, while a flexible Yoho Mobile eSIM keeps you seamlessly connected without the fear of bill shock. Together, they form the ultimate power couple for the modern globetrotter, allowing you to focus on what truly matters: experiencing the world.

Ready to upgrade your travel game for 2026? Explore Yoho Mobile’s flexible and affordable eSIM plans today!