Thailand—the Land of Smiles, vibrant street food, ancient temples, and stunning beaches. For decades, travelers prepared for this paradise by stuffing money belts with cash. But in 2025, the most crucial of all Thailand travel essentials isn’t a fanny pack; it’s your smartphone. From tracking the Thai Baht exchange rate in real-time to paying for a tuk-tuk with a tap, your phone is your new financial command center. And the one thing that powers it all? A stable, reliable internet connection.

Before you even pack your bags, ensure you have your digital key to a seamless trip. Check out Yoho Mobile’s eSIM plans for Thailand and land connected from the moment you arrive.

Why Stable Connectivity is Your Financial Superpower in Thailand

Think of a reliable data plan as financial insurance. In the past, you were at the mercy of airport currency exchange kiosks with notoriously poor rates. Today, a stable internet connection empowers you to:

- Track Live Exchange Rates: Instantly check the real-time Thai Baht (THB) rate on apps like XE Currency, ensuring you never get a bad deal.

- Access Mobile Banking: Securely manage your accounts, transfer funds, and approve transactions from anywhere, whether you’re on a beach in Phuket or a market in Chiang Mai.

- Make Informed Decisions: Look up reviews for vendors, compare prices on the spot, and avoid common tourist scams.

A strong connection isn’t a luxury; it’s a fundamental tool for managing your travel budget effectively and securely.

Mastering Mobile Payments: Your Phone is Your Wallet

Thailand has rapidly embraced a cashless society. While cash is still useful in very remote areas, QR code payments are now ubiquitous, from high-end malls in Bangkok to humble street food carts. The national standard, PromptPay, has made using phone for payments abroad incredibly simple for locals and increasingly accessible for tourists.

As a traveler, you can tap into this convenience by linking your credit or travel card (like Wise or Revolut) to ride-hailing and food delivery apps such as Grab. This eliminates the need for small change and provides a digital record of your spending. Imagine ordering a delicious Pad Thai and paying for it directly from your phone—it’s that easy.

This digital leap means a reliable Bangkok data plan is more critical than ever. You need to be online to generate the QR code or scan the vendor’s, making seamless connectivity your ticket to financial freedom. Ready to try it for yourself? Get started with a free trial eSIM to test your connectivity before you commit.

The Best Apps for Currency Exchange and Budgeting

Leverage your smartphone with apps that save you money and help you stick to your travel budget. A steady data connection is essential to use these tools on the go.

- Currency Exchange Apps: Services like Wise and Revolut offer multi-currency accounts with debit cards. You can top them up in your home currency and spend in THB at a much better exchange rate than traditional banks. They are indispensable for any modern traveler.

- Budgeting Apps: Apps like Tripcoin or Spendee help you track every baht. Log your expenses as you go, categorize them, and see exactly where your money is going. This is key to making your travel funds last longer.

Here’s a quick comparison of your money exchange options:

| Method | Convenience | Exchange Rate | Fees |

|---|---|---|---|

| Airport Money Changer | Low | Poor | High |

| Withdrawing from ATM | Medium | Fair | Medium |

| Using Digital Wallet Apps | High | Excellent | Low |

Don’t Get Caught Offline: The Smartest Connectivity Solution

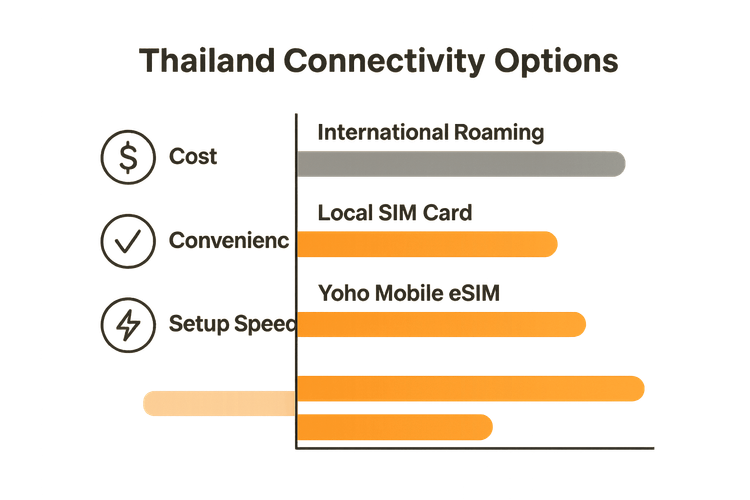

The last thing you want is to be unable to pay for a taxi or check your bank balance because you can’t find Wi-Fi. While traditional options exist, they come with drawbacks:

- International Roaming: Often prohibitively expensive, with shocking bills waiting for you back home.

- Local SIM Cards: Requires finding a store upon arrival, dealing with passport registration, and potentially struggling with language barriers—a hassle after a long flight.

This is where a Yoho Mobile eSIM changes the game. An eSIM (embedded SIM) is a digital SIM that lets you activate a cellular plan without a physical SIM card. With Yoho Mobile, you can buy and set up your Thailand data plan before you even leave home.

The Yoho Mobile Advantage:

- Instant Activation: Land in Thailand, turn on your eSIM line, and you’re instantly connected.

- Flexible Plans: Build a plan that fits your trip. Whether you need a lot of data for a month-long adventure or a small amount for a weekend trip, you only pay for what you need.

- Easy Installation: For iOS users, installation is a breeze. After purchase, just tap the ‘Install’ button—no QR codes to scan or codes to enter. Your eSIM is ready in under a minute.

Before purchasing, it’s always a good idea to check if your device is compatible on our official eSIM compatible devices list.

Frequently Asked Questions (FAQ)

Can I use my credit card everywhere in Thailand, or is cash still king?

While major hotels, upscale restaurants, and large stores readily accept credit cards, you’ll find that street vendors, local markets, and businesses in smaller towns are primarily cash or QR code-based. It’s best to have a mix: use cards where possible and have some cash and a digital payment app for smaller purchases.

What’s the safest way to manage my travel budget in Bangkok?

Adopt a multi-layered strategy for managing travel budget Thailand. Use a secure travel card or digital wallet (like Wise) for the majority of your payments to minimize the cash you carry. Keep a small amount of cash for emergencies, and diligently track your spending with a budgeting app on your phone. A reliable Bangkok data plan is crucial to ensure you can always access your accounts and make secure payments.

How can I get the best Thai Baht exchange rate using my phone?

To get the best rates, use currency exchange apps Thailand like Wise or Revolut. These platforms allow you to hold and spend money in THB, often at the mid-market exchange rate, which is far better than what you’ll find at physical exchange counters. Always use an app like XE Currency to check the live rate before any transaction.

Do I need a local bank account to use mobile payments in Thailand?

No, you don’t need a local account for many services. While the national PromptPay system is linked to Thai bank accounts, many popular apps like Grab (for rides and food) and Foodpanda allow you to link your international credit or travel card. This makes how to use mobile payments in Thailand simple and accessible for tourists.

Conclusion: Travel Smarter in Thailand

Modern travel in Thailand is digital travel. From navigating the bustling streets of Bangkok with Google Maps to paying for a bowl of delicious boat noodles with a QR code, your smartphone is your most powerful tool. The foundation of this convenient, cost-effective, and safe travel experience is a dependable internet connection.

Don’t let poor connectivity dictate your financial choices or add stress to your trip. By preparing with the right apps and a reliable eSIM, you can unlock a truly seamless adventure.

Ready to explore Thailand with confidence? Explore Yoho Mobile’s affordable and flexible eSIM plans for Thailand and unlock a smoother, more savvy travel experience!