The 2026 Guide to Securely Managing Your Finances While Traveling Abroad

Imagine this: you’re in a bustling market in Bangkok, you’ve found the perfect souvenir, but your card is declined. You need to check your banking app, but the cafe’s free Wi-Fi feels as trustworthy as a three-dollar Rolex. This scenario is an all-too-common travel nightmare, highlighting a critical aspect of modern globetrotting: secure travel banking.

Managing your money across borders doesn’t have to be stressful. This guide provides the best practices for accessing your bank accounts, receiving verification codes, and using financial apps safely from anywhere in the world. The key to it all? A secure and reliable internet connection. Before your next trip, ensure you have one with a flexible Yoho Mobile eSIM plan.

Why Your Home Bank Can Be a Hassle Abroad

While familiar, your traditional bank isn’t always the best travel companion. Travelers often face a trifecta of financial frustration:

- Sudden Account Freezes: Banks’ fraud detection systems can be overzealous. An unexpected login from Tokyo or a purchase in Rome could trigger an automatic block, leaving you stranded without access to your funds.

- Exorbitant Fees: From foreign transaction fees (often up to 3% of every purchase) to outrageous ATM withdrawal charges, the costs can quickly add up, eating into your travel budget.

- Access Hurdles: Many banking websites and apps are designed with domestic use in mind, making international access and verification a cumbersome process.

Your Pre-Travel Financial Checklist

Preparation is the best defense against financial headaches. Before you zip up your suitcase, complete this checklist:

- Notify Your Banks: Inform all your credit and debit card issuers about your travel dates and destinations. This simple step can prevent most automated account freezes.

- Understand the Fees: Review your cards’ policies on foreign transaction and international ATM fees. Consider getting a travel-specific credit card that waives these charges.

- Download and Update Apps: Make sure you have the latest versions of your banking and financial apps installed and that you can log in successfully before you leave.

- Diversify Your Payments: Don’t rely on a single card. Carry a mix of payment methods: a primary credit card, a backup credit card, a debit card for ATM withdrawals, and some local currency for small purchases.

Solving the Two-Factor Authentication (2FA) Puzzle Abroad

One of the biggest challenges of modern travel banking is receiving two-factor authentication (2FA) codes. Your bank sends a code to your phone to verify it’s really you, but what happens when your home SIM card is out of network range?

The Problem with SMS-Based 2FA

Relying on your home SIM for SMS codes can be a gamble. You might face exorbitant international roaming charges just to receive a single text, or worse, the message might not arrive at all due to network incompatibility.

Modern Solutions: Authenticator Apps

The safest and most reliable method is to switch to an app-based authenticator. Apps like Google Authenticator or Authy generate time-sensitive codes directly on your device, no cell signal required. Check your bank’s security settings before you travel to see if you can enable this option. For more information on how 2FA works, you can consult resources from the National Institute of Standards and Technology (NIST).

The Critical Importance of a Secure Connection

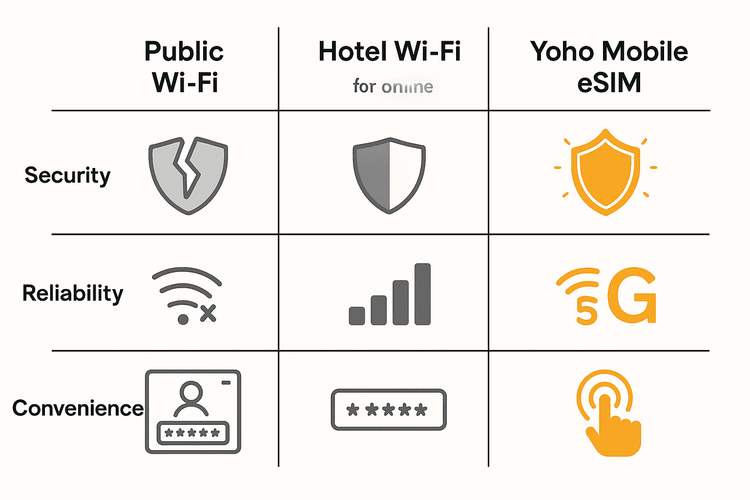

How you connect to the internet abroad is just as important as which card you use. When you log into your bank, you’re transmitting your most sensitive information.

The Dangers of Public Wi-Fi

Free Wi-Fi in cafes, airports, and hotels is tempting, but it’s a minefield for security risks. These open networks are prime targets for hackers who can perform “Man-in-the-Middle” attacks to intercept your data, capturing usernames, passwords, and account numbers. Using a public network for financial transactions is a risk not worth taking.

Your Private Data Connection: The eSIM Shield

The safest way to access online banking while traveling is through a secure, private mobile data connection. An eSIM from a trusted provider like Yoho Mobile acts as your personal, encrypted gateway to the internet.

Unlike public Wi-Fi, your eSIM connection is private to your device, shielding your financial activities from prying eyes. Whether you’re transferring money in the mountains of Switzerland or paying a bill from a beach in Thailand, an eSIM provides peace of mind. With Yoho Mobile’s flexible plans, you can get just the right amount of data for your trip. Get peace of mind and secure connectivity on your next adventure with a Yoho Mobile eSIM.

Leveraging FinTech for Smarter Travel Finance

Financial technology (FinTech) has revolutionized travel banking. Services like Wise (formerly TransferWise) and Revolut offer multi-currency accounts, near-perfect exchange rates, and transparent, low fees that legacy banks can’t match. As reported by outlets like TechCrunch, these platforms are designed for a global user base.

Using a FinTech service can be a great way to manage your travel budget, pay in local currencies, and avoid the sting of poor exchange rates. It’s an essential tool for the modern traveler.

Frequently Asked Questions (FAQ)

What’s the safest way to access online banking while traveling?

The absolute safest method is to use a secure, private mobile data connection, such as a Yoho Mobile eSIM, and avoid public or unsecured Wi-Fi networks completely. Combine this with strong passwords and an app-based two-factor authentication (2FA) for maximum security.

How can I receive bank verification codes overseas without high roaming fees?

The best option is to switch your bank’s 2FA method to an authenticator app (like Google Authenticator or Authy) before you leave. If you must receive SMS codes, an eSIM allows you to use affordable local data while keeping your primary line active just for receiving texts, thus avoiding data roaming charges from your home carrier.

Are fintech apps like Revolut or Wise safe for international travel?

Yes, reputable fintech companies are generally very safe. They are often regulated financial institutions that use robust security measures, including encryption and advanced fraud detection. They are specifically designed for international use, making them a secure and cost-effective choice for travelers.

What should I do if my bank blocks my card while I’m abroad?

First, don’t panic. Contact your bank immediately using their international or collect-call helpline. This is another reason why a reliable data connection is essential; you can use apps like Skype or WhatsApp to make the call over the internet without incurring massive phone charges. Having a backup card is also crucial in this situation.

Conclusion: Travel with Financial Confidence

Managing your travel finance abroad is no longer a daunting task. By preparing before you leave, leveraging modern fintech tools, and—most importantly—prioritizing a secure internet connection, you can stay in complete control of your money.

A reliable eSIM is the cornerstone of secure travel banking. It empowers you to check balances, transfer funds, and communicate with your bank safely from anywhere on the globe. With the added protection of Yoho Care, you’ll never have to worry about losing connection in a critical moment.

Ready to make financial stress a thing of the past? Try a free Yoho Mobile eSIM today and experience the security and freedom of seamless global connectivity.