¿Es seguro el Wi-Fi de un hotel para operaciones bancarias? Una guía de seguridad para 2025

Bruce Li•Sep 20, 2025

Acabas de registrarte en tu hotel después de un largo vuelo y necesitas consultar rápidamente el saldo de tu cuenta bancaria o realizar un pago. El Wi-Fi gratuito del hotel parece la solución perfecta. Pero justo cuando estás a punto de introducir tu contraseña, una pregunta persistente aparece en tu cabeza: ¿es seguro el Wi-Fi de un hotel para operaciones bancarias?

La respuesta corta es: es arriesgado. Las redes públicas, incluidas las de los hoteles, a menudo no son seguras, lo que las convierte en un campo de juego para los ciberdelincuentes. Pero no te preocupes, esta guía te explicará los peligros y te proporcionará pasos claros para proteger tus finanzas. Para una tranquilidad total, una conexión de datos móviles personal a través de una eSIM es tu mejor opción. Comienza con una prueba de eSIM sin riesgo de Yoho Mobile antes de tu próximo viaje.

Los peligros ocultos del Wi-Fi de hotel

La comodidad a menudo tiene un precio, y con el Wi-Fi gratuito, ese precio puede ser tu seguridad. Las redes de los hoteles son objetivos principales para los hackers porque atienden a un flujo constante de nuevos usuarios que pueden no ser expertos en seguridad. Estos son los principales riesgos de la banca online en redes públicas:

- Redes no cifradas: Muchas redes Wi-Fi de hoteles no cifran los datos que viajan entre tu dispositivo y el router. Esto significa que un hacker en la misma red podría interceptar fácilmente tu información, incluyendo nombres de usuario, contraseñas y detalles de tarjetas de crédito.

- Ataques “Man-in-the-Middle” (MitM): Esta es una amenaza común en la que un ciberdelincuente se posiciona entre tu dispositivo y el router Wi-Fi. A continuación, puede monitorear, capturar e incluso alterar tus datos sin que te des cuenta. Incluso podrían configurar una red Wi-Fi falsa con un nombre similar al del hotel, engañándote para que te conectes a su trampa.

- Distribución de malware: Las redes inseguras pueden utilizarse para inyectar malware en los dispositivos conectados. Este software malicioso puede registrar tus pulsaciones de teclas o robar archivos sensibles mucho después de que te hayas desconectado.

Cómo proteger tus datos financieros en redes públicas

Si es absolutamente necesario que utilices el Wi-Fi del hotel para transacciones sensibles, es crucial tomar precauciones. Piensa en ello como mirar a ambos lados antes de cruzar la calle: estos sencillos consejos de ciberseguridad para viajeros pueden ahorrarte muchos problemas.

Usa una VPN (Red Privada Virtual)

Una VPN es tu mejor amiga cuando se trata de la seguridad en redes Wi-Fi públicas. Crea un túnel cifrado para tus datos, haciéndolos ilegibles para cualquiera que intente espiar tu conexión. Usar una VPN para realizar operaciones bancarias seguras mientras viajas es un paso no negociable. Codifica tu información, por lo que incluso si un hacker la intercepta, no podrá entenderla.

Verifica la legitimidad de la red

Antes de conectarte, confirma siempre el nombre oficial de la red Wi-Fi del hotel en la recepción. Los hackers a menudo crean redes señuelo como “WIFI Huéspedes Hilton” en lugar de la oficial “Hilton Honors”. Un pequeño error tipográfico podría llevar a un gran problema.

Busca “HTTPS”

Comprueba siempre que el sitio web en el que te encuentras comience con https:// (la ‘s’ significa seguro) y muestre un icono de candado en la barra de direcciones. Esto indica que la conexión entre tu navegador y el sitio web está cifrada. Sin embargo, esto no te protege de todas las amenazas en una red insegura, por lo que una VPN sigue siendo esencial.

Activa la autenticación de dos factores (2FA)

Para todas tus cuentas financieras y de correo electrónico, activa la 2FA. Esto significa que incluso si alguien roba tu contraseña, no podrá iniciar sesión sin una segunda forma de verificación, generalmente un código enviado a tu teléfono. Esto añade una capa crítica de seguridad.

La apuesta más segura: tu propia conexión privada con una eSIM

Si bien los consejos anteriores pueden reducir tu riesgo, la forma más efectiva de garantizar la seguridad online en tus viajes es evitar por completo el Wi-Fi público para tareas sensibles. Aquí es donde brilla una conexión de datos móviles, y una eSIM de viaje de Yoho Mobile lo hace más fácil y asequible que nunca.

Las redes móviles como 4G y 5G tienen un cifrado robusto e integrado que es mucho más seguro que una red Wi-Fi pública típica. Al usar una eSIM, creas tu propia burbuja de internet privada y segura, evitando por completo la vulnerable red del hotel.

Con una eSIM de Yoho Mobile, puedes:

- Conectarte al instante: Obtén acceso seguro a internet en el momento en que aterrizas. No hay necesidad de buscar contraseñas de Wi-Fi ni arriesgarse a conectarse a una red insegura.

- Viajar con confianza: Ya sea que estés reservando un tren en Japón o revisando tu cartera en los EE. UU., estás utilizando una conexión diseñada para la seguridad. Explora planes de datos flexibles para cualquier destino.

- Mantenerte protegido con Yoho Care: Incluso si se te acaban los datos de alta velocidad, Yoho Care garantiza que nunca estés completamente desconectado, proporcionando una conexión básica para tareas esenciales. Esto significa que no te verás forzado a conectarte a un Wi-Fi público arriesgado en una emergencia. Obtén más información sobre esta característica única en nuestra página sobre Yoho Care.

Antes de viajar, siempre es una buena idea comprobar si tu dispositivo es compatible. La mayoría de los smartphones modernos admiten la tecnología eSIM, y puedes ver la lista completa en nuestra página de dispositivos compatibles con eSIM.

Preguntas frecuentes (FAQ)

P: ¿Es seguro usar mi tarjeta de crédito en el Wi-Fi de un hotel?

R: No es recomendable. Usar una tarjeta de crédito en el Wi-Fi de un hotel expone el número de tu tarjeta, la fecha de vencimiento y el CVV a una posible interceptación por parte de hackers. Para las compras online, es mucho más seguro utilizar una conexión móvil segura, como una eSIM, o una VPN si debes usar el Wi-Fi.

P: ¿El Wi-Fi del hotel está cifrado para transacciones financieras?

R: No siempre. Muchas redes de hoteles utilizan un cifrado básico o nulo, lo que las hace inseguras. Si bien el sitio web del banco (HTTPS) cifra los datos, un hacker sofisticado en una red abierta aún puede encontrar vulnerabilidades. No deberías depender de la red del hotel para tu seguridad.

P: ¿Cómo hace una VPN que las operaciones bancarias en Wi-Fi público sean más seguras?

R: Una VPN cifra todo el tráfico de internet que sale de tu dispositivo. Esto significa que, incluso si estás en una red de hotel no segura, tus datos se codifican en un código ilegible antes de que lleguen al router del hotel, protegiéndolos de cualquiera que intente espiar la red.

P: ¿Puedo usar mi aplicación bancaria con una eSIM de solo datos?

R: Sí, por supuesto. Las aplicaciones bancarias utilizan datos de internet para funcionar, no llamadas telefónicas tradicionales ni SMS. Una eSIM de solo datos proporciona la conexión a internet segura que tu aplicación necesita para funcionar de forma segura en cualquier parte del mundo, permitiéndote gestionar tus finanzas sin depender de redes Wi-Fi públicas arriesgadas.

Conclusión: no te la juegues con tu seguridad financiera

Aunque la tentación del Wi-Fi gratuito de un hotel es fuerte, los riesgos potenciales para tu información financiera son demasiado significativos como para ignorarlos. Para una navegación casual, puede estar bien, pero para operaciones bancarias, compras o cualquier actividad que involucre datos sensibles, necesitas una solución mejor.

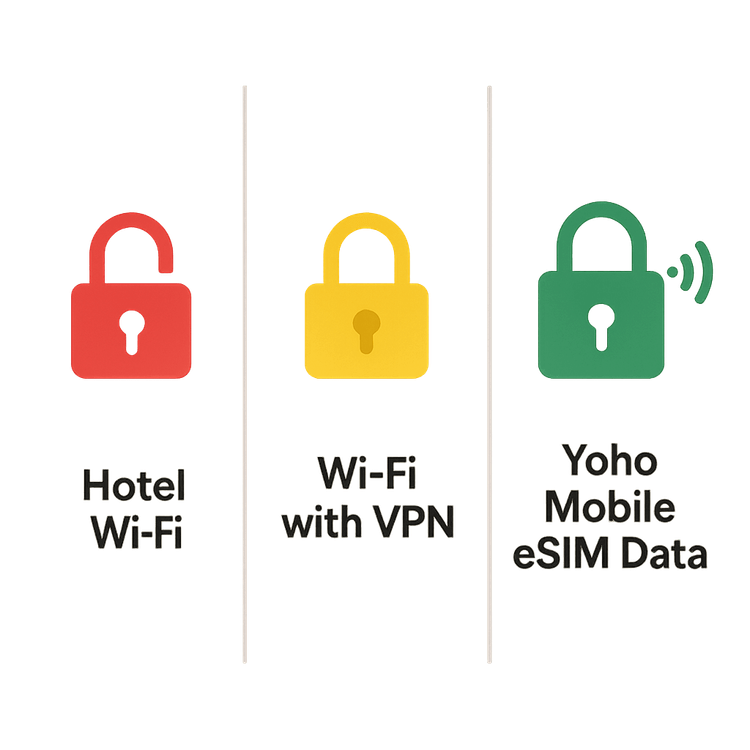

Protégete con un enfoque de múltiples capas: usa una VPN, verifica las redes y busca el HTTPS. Pero para una verdadera tranquilidad y lo último en acceso seguro a internet en el extranjero, nada supera tener tu propia conexión móvil privada.

¿Listo para hacer tu próximo viaje más seguro? Echa un vistazo a los planes de eSIM flexibles y asequibles de Yoho Mobile hoy mismo y viaja con la confianza de que tus datos están protegidos.